6. Fill out your tax forms

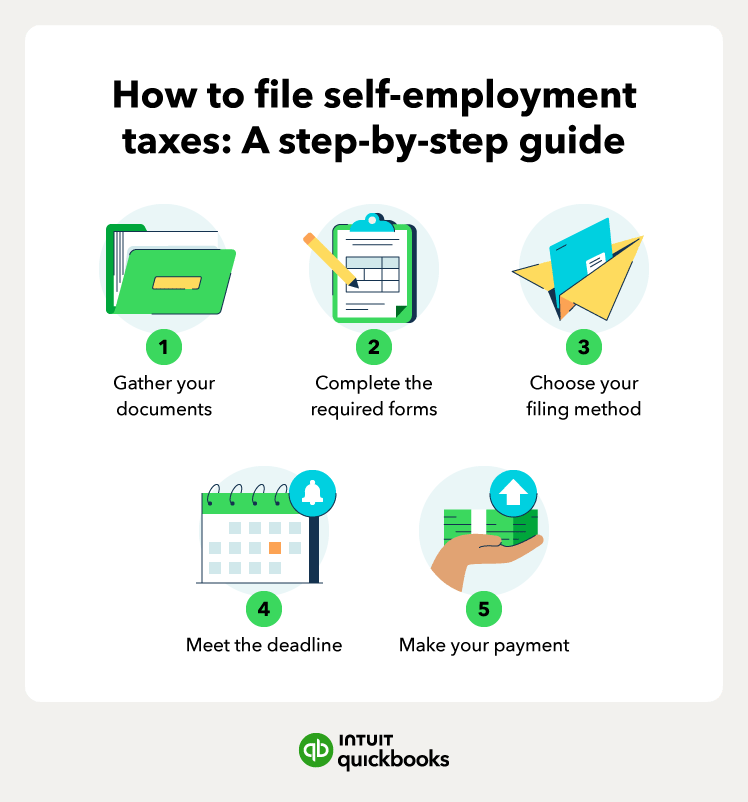

When filling out an annual tax return, self-employed workers need to complete several tax forms and schedules to accurately report their income, calculate self-employment taxes, and claim deductions.

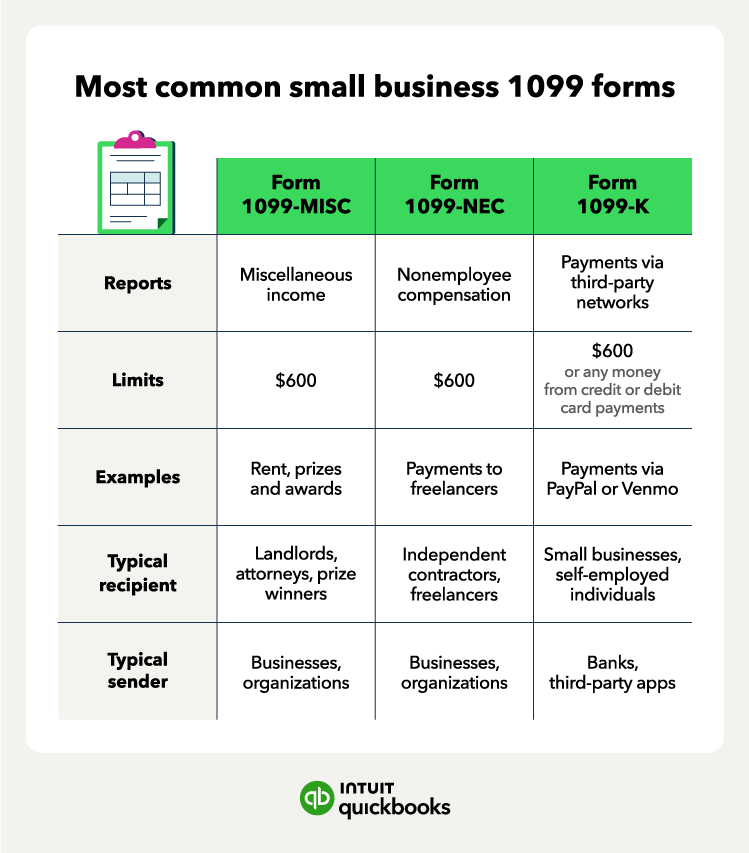

Before you start, ensure you have all the essential information readily available. This includes your Social Security Number (or Individual Taxpayer Identification Number), all your income records (like 1099-NEC forms and invoices), and your expense records to support your deductions. If you're paying electronically, you'll also need your bank account information.

Next, fill out the required forms.

The IRS has specific forms for reporting self-employment income and calculating your tax:

Form 1040

Individual taxpayers use this form to report their income and calculate their tax liability, whether they’re self-employed or not.

Schedule C

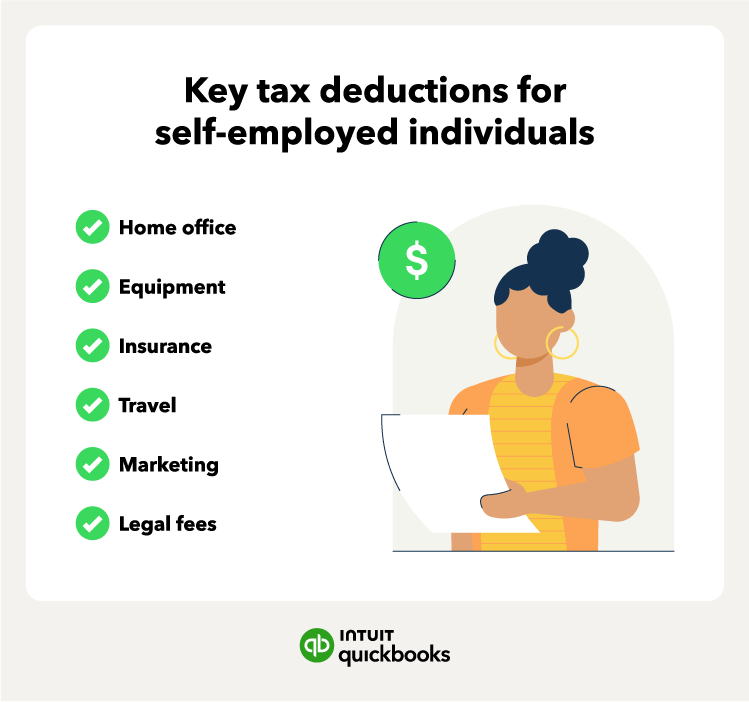

Schedule C is specifically for reporting profit or loss from your business (or businesses) if you're self-employed. You'll report your gross income and deduct your allowable business expenses to arrive at your net profit or loss. This net profit figure is then carried over to Form 1040 and Schedule SE.

Schedule SE

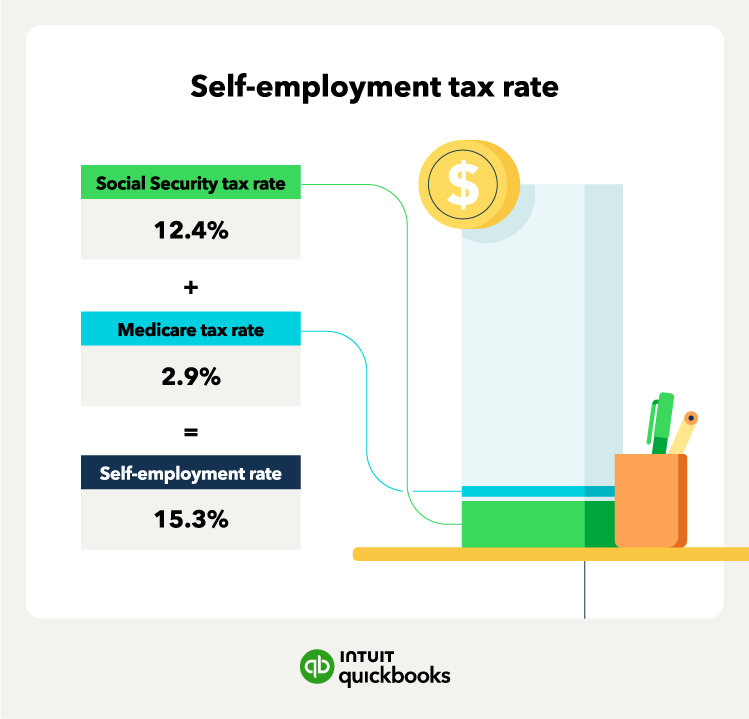

Schedule SE is where you'll calculate your self-employment tax, which covers your Social Security and Medicare contributions. You'll use the net earnings from your Schedule C to determine this amount. The calculated self-employment tax is then reported on your Form 1040.

Self-employed taxpayers are entitled to deduct one-half of their self-employment tax from their taxable income.

Self-employed taxpayers are entitled to deduct one-half of their self-employment tax from their taxable income.